21st December 2023

Dear Investors,

We are pleased to provide this investor update with respect to the ASCF Private Fund.

Since our last quarterly update, the fund has continued to perform strongly, and we would like to take this opportunity to provide you with detailed information on each of the investments in the fund as at 30th September 2023.

Key Fund Information

Funds under management as at 30th September 2023: $34,290,199.45

Current unit price – $1

Income distribution for November 2023: Paid

Fund Investments as at 30th September 2023

ASCF Private Fund, via its wholly-owned sub-fund Australian Mortgage Finance Services Fund (AMFS), has undertaken several investments under its mandate since inception and listed below are the current list of investments as at the 30th September 2023.

ASCF High Yield $9,453,402.63 (refer note 1.)

ASCF Select Income Fund $3,000,000 (refer note 1.)

ASCF Premium Capital Fund $1,600,000 (refer note 1.)

Direct Loan Investments $20,578,392.31 (refer note 4.)

Cash at Bank ASCF Private $66,842.21

Cash at Bank AMFS $108,907.22a

ASCF Private and AMFS Half Year Financials

The financial statements for ASCF Private and its wholly owned sub fund Australian Mortgage Finance Services for the full year ended 30th June 2023 have been finalised and are available for viewing by clicking here.

Note 1. ASCF High Yield and ASCF Select Income

AMFS has $9,453,402.63 invested in ASCF High Yield Fund, $3,000,000 invested in ASCF Select Income Fund, and $1,600,000 invested in ASCF Premium Capital Fund, all being retail funds managed by Australian Secure Capital Fund Ltd.

AMFS, as a wholesale investor, receives a preferential rate of 8.60% per annum paid monthly from the funds due to the amount invested.

All interest payments have been made on time and in full by ASCF High Yield and ASCF Select Income to AMFS at the prescribed rate on the due dates.

The audited financials for each of the retail funds for the full year ended 30th June 2023 are available for viewing or download by clicking here.

For further information concerning our retail funds, please refer to the Product

Disclosure Statement by clicking here or visit our website ascf.com.au where you will be able to view our monthly updates on our retail funds.

ASCF Managed Investments Pty Ltd C Class Notes

ASCF Managed Investments Pty Ltd (ASCFMI) is a part of the ASCF Group of Companies and issued a $35m bond in September 2018 by issuing A, B and C Class Notes, which were fully subscribed.

A copy of the IM for ASCF Managed Investments Pty Ltd is available by clicking here.

ASCF Private, via its sub-fund AMFS, acquired the C Class notes on the 17th of June 2021 for a consideration of $3,000,000 at par value. These notes earn 15% per annum, payable monthly by the Mortgage Capital Australia Trust, which acts as the service entity to the ASCF Group. This transaction was foreshadowed in the ASCF Private Information Memorandum under clause 3.2(b).

Since the completion of the transaction, all interest payments have been made on time and in full by the Mortgage Capital Australia Trust to AMFS at the prescribed rate on the due dates.

ASCF Managed Investments Pty Ltd New C Class Notes Issue

On the 7th of December 2021, ASCF Managed Investments Pty Ltd issued additional C Class notes totaling $4,040,000. On the same day, it redeemed the B Class notes then on issue totaling $4,000,000.

These notes were issued on the same terms as the existing C class notes. The notes were acquired by AMFS and earn interest of 15% per annum payable monthly by the Mortgage Capital Australia Trust.

Since the completion of the transaction, all interest payments have been made on time and in full by the Mortgage Capital Australia Trust to AMFS at the prescribed rate on the due dates.

On the 18th September 2023 the C class notes with a face value of $7,040,000 were redeemed by ASCF Managed Investments Pty Ltd. ASCFMI received $7,705,232.53 via an assignment of 13 loans from ASCFMI to AMFS with ASCFMI reimbursed for the difference of $665,232.53 in cash.

These loans are a combination of 1st and 2nd mortgages and further details including key statistical information in relation to all direct loans held by AMFS are listed below.

Note 4. Direct Loan Investments

AMFS direct loan investments to date have been loans acquired via assignment from the ASCF retail funds and ASCF Managed Investments Pty Ltd at reasonably conservative loan to valuation ratios some of which may be in arrears.

The benefit of acquiring loans in arrears is that the interest rate applicable to these loans is higher than the standard rate charged to borrowers who pay their interest on time.

These loans, therefore, offer a high internal rate of return on the capital invested in the loan presuming the full loan value including all loan interest and fees are recovered.

In addition to acquiring loans in default from our retail funds AMFS also originates new loans either in its own right or jointly funded loans with the ASCF Retail Funds at interest rates that provide a healthy net interest margin.

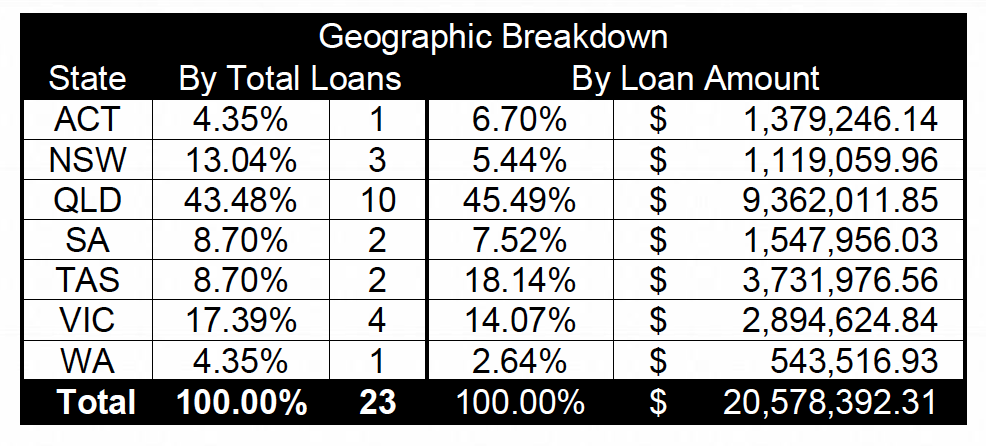

Listed below are the details of the current direct loan investments held by AMFS as at the 30th September 2023.

| Total Direct Loans Held by AMFS | $20,578,392.31 |

| Value of all 1st Mortgage Loans | $18,691,168.62 |

| Value of all 2nd Mortgage Loans | $1,887,223.69 |

| Average Loan Size in AMFS Fund | $894,712.71 |

| Average Weighted LVR | 71.86% |

| Average LVR | 66.28% |

| Average Weighted Annual Interest Rate | 18.4582% |

| Average Weighted Annual Interest Rate incl. Service Fee | 18.7065% |

| Average Annual Interest Rate | 19.24% |

| Average Monthly Interest Rate | 1.60% |

| Average 1st Mortgage Loan Amount | $983,745.72 |

| Average 2nd Mortgage Loan Amount | $471,805.92 |

| Number of 1st Mortgage Loans | 19 |

| Number of 2nd Mortgage Loans | 4 |

| Number of all Loans | 23 |

We will continue to provide additional updates with respect to the ASCF Private Fund every quarter, but should you have any queries or questions in the interim, please do not hesitate to contact me directly.

Regards,

Filippo Sciacca

Director

Investor Relations, Asset Management & Compliance – Australian Secure Capital Fund Ltd